Introduction

Germany offers many opportunities for foreign entrepreneurs. People who plan to start a business are faced with a number of legal questions.

The most important one is possibly what legal form they should chose for their business. This decision entails many considerations including taxation, personal liability and risks, required capital and transparency requirements, to name just a few.

For non-German citizens, additional questions arise regarding their residence status and required permits.

Is it necessary to take residence in Germany or is it possible to run a business from abroad? Is it possible to obtain a residence status for the purpose of opening a business and what additional permits are required?

These questions have to be considered carefully in each individual case. General information cannot replace the thorough assessment of a specific situation. Still, I am going to provide some basic information as a starting point.

Legal form – legal entity or personal business?

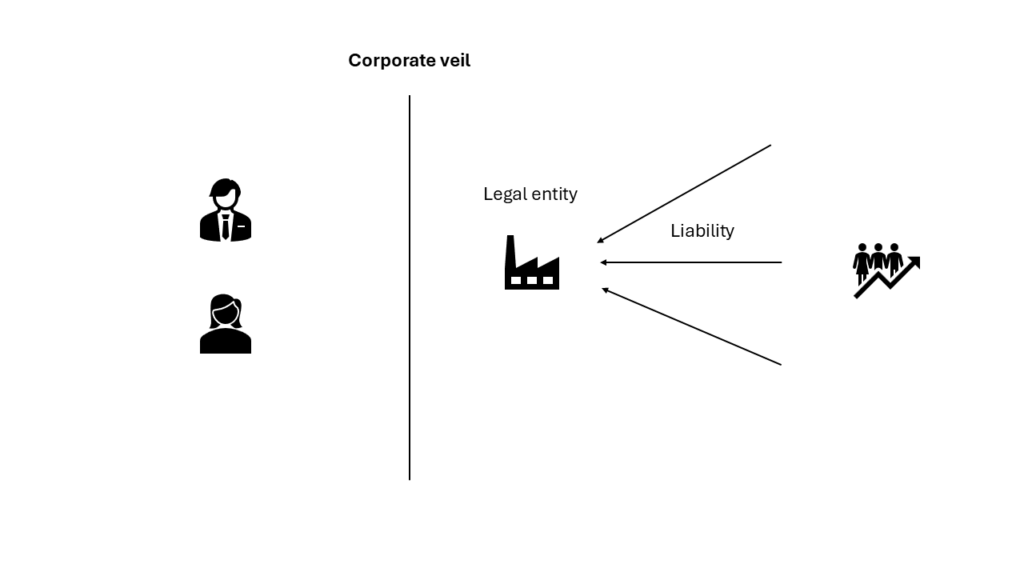

In German law (as in the law of many other countries), there are two ways to run a business: In form of a legal entity or personally.

Legal entity means that a corporation with its own legal personality is created. This ‚legal person‘ can act in the marketplace like a person; in particular, it has ist own assets. This entails a limitation of personal liability for the persons who own the corporation. Only the ‚legal person‘ itself is liable to pay debts of the corporation. Creditors of the legal person cannot access the assets of person who run the corporation or own shares (there are exceptions to this rule in very specific circumstances). In cases where the assets of the corporation are not sufficient to meet the financial obligations, the company is insolvent and can be dissolved.

The flipside is that legal entities are much more regulated than businesses run by natural persons or in form of assiciations of such persons. Since (potential) business partners are dealing with a legal entity, they shall be able to rely on certain condictions being met. Therefore, the process of forming a legal entity is more formalized and legal entities are in many cases subject to publication requirements.

Alternatively, entrepreneurs can run their business personally. That means that they either act as a sole traders or as an association of persons. This form of running a business is less regulated; setting up the business is quicker and less costly. On the other hand, the personal liability is not limited. Ultimately, there is no separation between personal asses and assets owned by the business. Creditors may hold business owners personally liable if the business does not meet its financial and contractual obligations. This should be seriously considered by business owners concerned about their personal risk.

Personal liability is a key consideration, but it’s not the only one. Legal entities face varying tax regulations, and intangible aspects like reputation also require attention.

Sole traders or associations may not enjoy the same degree of respect in the marketplace in some cases. Establishing a legal entity, with all the effort it requires and the consequences it entails conveys the message that a founder is serious about the business. This does not apply to sole traders.

On the other hand, the personal liability of a sole trader or an association may be conceived positively. Business partners know that they are dealing with a person who is willing to put personal assets on the line.

Thus, the pros and cons of running a business in a specific form must be weighed carefully in each case.

Legal entities

Overview

There are different types of legal entities available under German law. The most imporant ones are the ‚Aktiengesellschaft“ (Public Limited Company), short AG, and the Gesellschaft mit beschränkter Haftung (Limited Liability Company), short GmbH.

The ‘Aktiengesellschaft’ (AG)

The main purpose of the AG is to raise large amounts of capital. There are about 12.500 AGs in Germany; most large companies operate as AGs.

The law distinguishes two types of AG: Publicly listed companies and privately held companies. Publicly listed companies, whose shares are traded on a stock exchange are more strictly regulated than companies which privately held.

AGs have a minimum share capital of 50.000 €. By law, they have three governing bodies: An executive board, which manages the day to day business; a supervisory board, which is oversees the work of the executive board an is in charge of strategic decisions and an Annual General Meeting, which gathers the shareholders.

Because AGs are strictly regulated, they are generally not a viable option for most individuals or businesses looking to enter the German market.

The Gesellschaft mit beschränkter Haftung (GmbH) – Limited Liability Company

The GmbH (and its special form, the UG) is among the most popular ways to run a business in Germany. Its attractive combination of limited liability and modest capitalization requirements makes it a popular choice for many founders.

Video: The GmbH in Germany

You can find some information on the GmbH in Germany in the following video or in this article:

If you prefer reading or would like more detailed information, you can download my free e-book on the GmbH in Germany.

Ready to dive deeper into the legal characteristics of the German GmbH? Download my free e-book today for comprehensive insights!”

Personal businesses

Businesses run by individuals

There are several ways to run a business in Germany without creating a separate legal entity. The primary consideration here is whether the business will be operated by only one person or by several.

Businesses run by an individual offer the advantage of having no statutory capital requirements, and the administrative formalities are generally very limited. (Of course, practical capital may still be required to start a business depending on its nature, but there is no formal legal minimum as there is for a GmbH).

Individuals may operate their business either as small business owners (Kleingewerbetreibende) or as merchants (Kaufleute). This distinction is primarily drawn from the German Commercial Code (HGB). If a business, due to its nature and scale, requires a commercially organized business operation, the person running it is considered a merchant. A “commercially organized business” implies that the size of the business and its revenue necessitate a certain structure regarding bookkeeping, documentation, and contract management, among other things. While there’s no strict legal cut-off, businesses generating an annual revenue of approximately €250,000 or more are generally presumed to be merchants.

As merchants, business owners must comply with specific requirements, particularly concerning accounting, which is more rigorous than for small businesses. Special rules also apply in areas such as the conclusion of contracts. Merchants are legally required to register themselves in the commercial register (Handelsregister).

Small businesses, on the other hand, are those that do not require a commercially organized business operation. These are typically businesses whose annual revenue does not reach the aforementioned threshold of approximately €250,000.

Nevertheless, small businesses are still subject to certain rules regarding accounting and other matters, which derive from tax laws and other provisions.

Regardless of the business’s size, owners must promptly inform the local revenue office (Finanzamt) about the start of their activities. They also typically need to register with the local trade licensing office (Gewerbeamt). In some cases, a specific permission or license may be required to run a certain type of business. However, this depends on the type of business activity, not on the legal form in which it is run; meaning it applies irrespective of whether the business is operated by a sole trader or a by a legal entity.